Let’s Look at the Difference Between CBDCs and ADA

Let’s Look at the Difference Between CBDCs and ADA

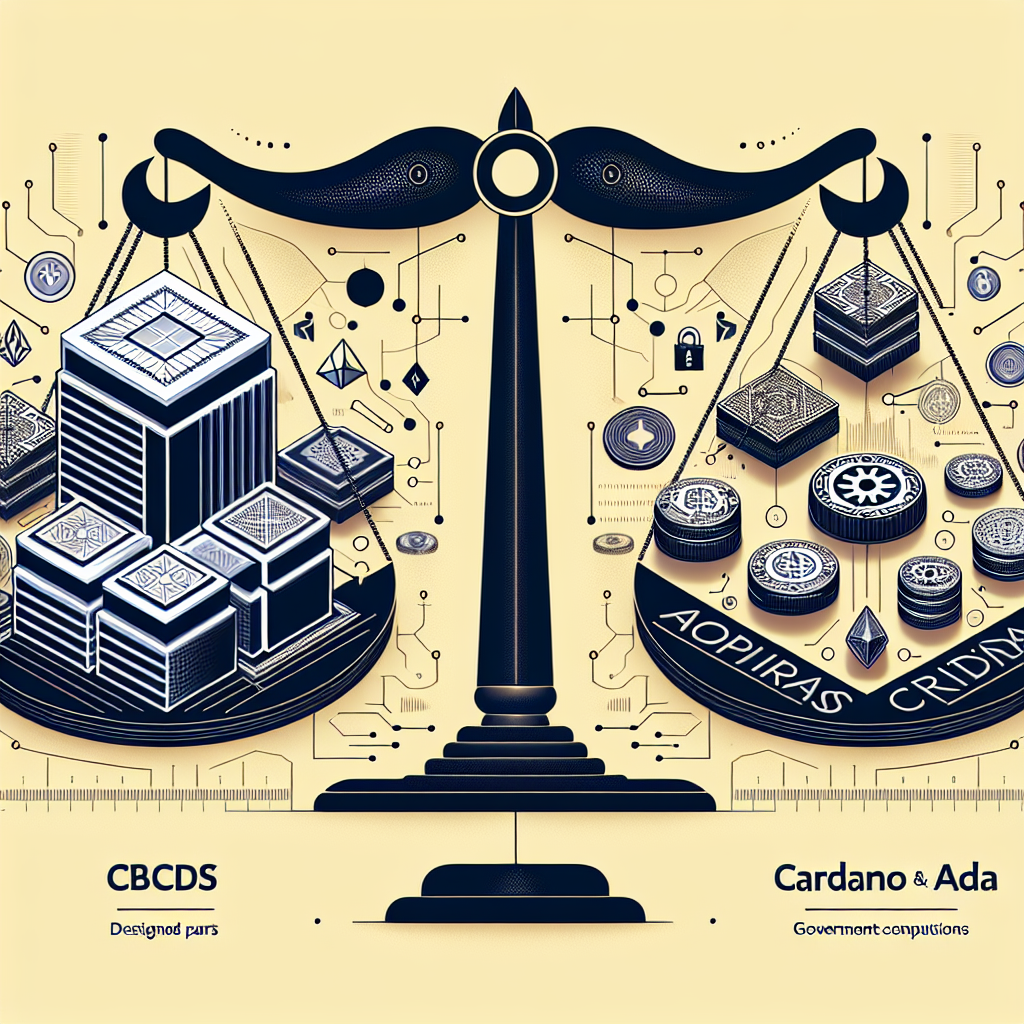

Central Bank Digital Currencies (CBDCs) and Cardano's ADA operate on different premises and serve different purposes.

CBDCs are digital forms of fiat money, issued by a country's central bank. They are a digital equivalent of a country's physical currency, are centralized, and fall under the direct control and regulatory jurisdiction of the central banking system. The primary purpose of CBDCs is to digitalize the current monetary system, facilitate faster and cheaper transactions, and offer greater financial inclusion.

On the other hand, Cardano is a decentralized, open-source project that aims to run a public blockchain platform for smart contracts. ADA, the native cryptocurrency of Cardano, facilitates quick and direct transfers of value and supports the execution of smart contracts on the Cardano blockchain. ADA is decentralized and operates independently from traditional banking systems.

While CBDCs aim to improve the existing financial framework, Cardano seeks to provide an alternative, decentralized platform for executing software contracts, thereby challenging the traditional financial system.

However, it's important to remember that despite their differences, both CBDCs and ADA represent exciting progress in the evolution of digital finance. Each investor should thoroughly research and understand these concepts before making any decision related to these digital assets.

Potential Drawbacks of Each

• CBDCs, within their centralized framework, bear several potential drawbacks. Privacy concerns are one; while they would allow for greater oversight of financial transactions, this could translate into excessive surveillance by governments. Moreover, while CBDCs could simplify the regulation of digital money, they can also be subject to cyber-attacks, and their centralization could create single points of failure.

• Regarding Cardano and ADA, while decentralization carries many advantages, it isn't without its downsides. First, the Cardano protocol's "slow and steady" approach can seem overly cautious and slow-paced to some investors, particularly in the rapidly-evolving world of cryptocurrencies. Also, the complexity of Cardano's academic and scientific approach may be daunting for some individuals. Additionally, like all cryptocurrencies, ADA's value can be highly volatile, and the lack of a central authority means there's no safety net if things go wrong.

As always, potential investors should thoroughly research and consider these drawbacks and their risk tolerance before entering the digital currency market.

Mike Gilhooly / $websize / mikegilhooly.com

Comments

Display comments as Linear | Threaded